Demand Outlook

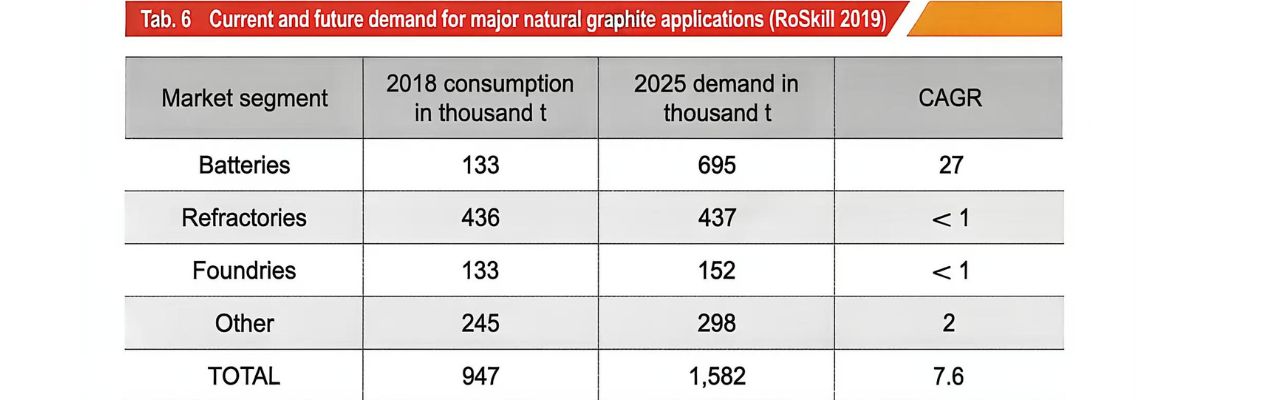

Global demand for natural graphite is forecast to increase by over 7% annually until 2025, representing a 67% increase over consumption in 2018(Tad.6). The steel industry has traditionally been a major driver for the consumption of natural graphite though its use of refractory products. However, as demand from the refractory industry is forecast to remain constant over the nest few years, due the slow growth of crude steel production and the use of higher efficiency furnaces, its share in global natural graphite demand is set to decrease, as it is eclipsed by the growing demand from the battery sector. Depending on economic factors, such as market penetration and uptake, compound annual growth rates for the battery sector are the only application to reach double digits, as more and more countries around the world are stepping up their efforts to promote the development and utilization of renewable energy in a move towards a lower emissions future in the transport and energy sectors.

Global flake graphite demand is expected to increase at a slightly higher rate of almost 10% until 2025, mainly on the back of the developing battery industry, where flake graphite is used in the manufacture of spherical graphite for lithium-ion batteries for high-performance applications such as electric vehicles. Demand for amorphous graphite is expected to decrease over the same period by approximately 2%. One reason for this decrease in demand is the increasing availability of dines from spherical graphite production.

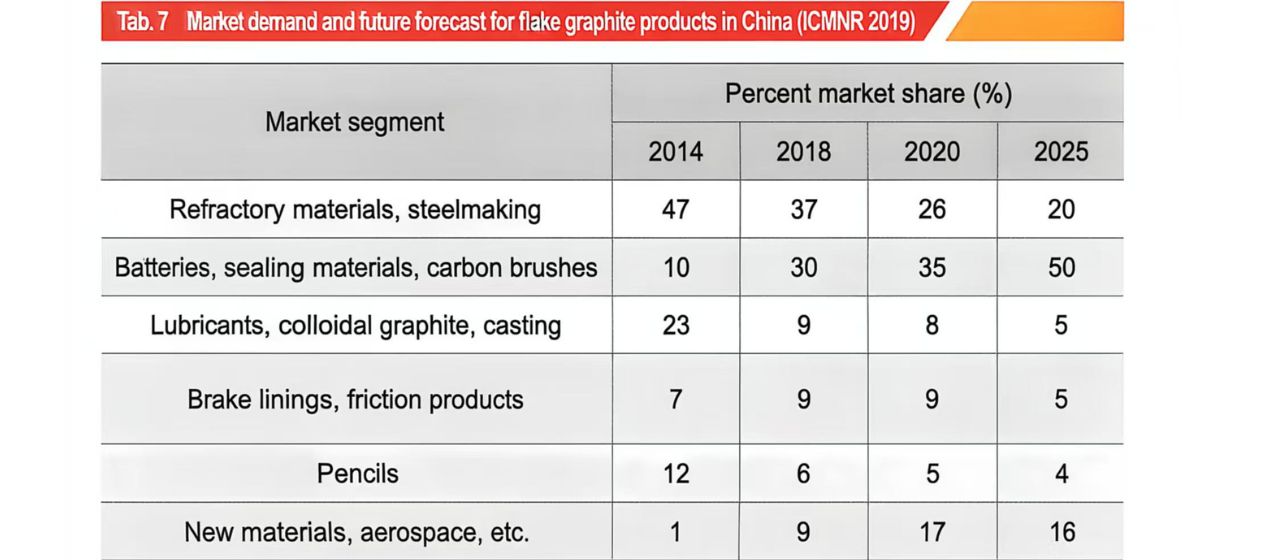

Chinese natural graphite consumption is expected to be excess of 1.3 million ton in 2020(ICMNR 2019), with flake graphite accounting for over 73%. Mirroring the global trend of a decrease in consumption for traditional applications such as refractories, lubricants and pencils, growth rates for Chinese consumption are highest in new energy materials applications such as batteries(Tab.7).

Supply Outlook

A deficit in the supply of natural graphite solely based on the overall amount of raw material available is unlikely in the next few years, as the market continues to be in oversupply and capacities are far bigger than current consumption. Consolidations across the amorphous graphite industry have led to a decrease in Chinese supply. This development has also affected the flake graphite industry, though to a lesser extent, as mines are distributed across a larger number of provinces. Ongoing environmental inspections in a bid to curbpollution and meet strict environmental targets have affected Chinese flake graphite mines and led to temporary closures in the past few years. Pollution is particularly an issue regarding the processing of flake graphite into downstream products.

World mine production is set to increase over the next few years and is expected to adequatedly meet increasing global demand. However, China’s dominance as the world’s leading producer is likely to be challenged. As the main flake graphite consumer and with domestic flake graphite consumption increasing, China has started to import increasing amounts of raw material to supplement domestic production as feedstock for the battery industry in particular. This trend is likely to continue as the battery industry continues to be mainly centered in Asia.

In further efforts to reshape its domestic graphite industry, China’s further production capacities are likely to change; however, no official capacity figures has been released at the time of publication. For example, in 2017, affected by environmental inspections in Shandong, some enterprises shut down and they are yet to reopen. In the luobei area of Heilongjiang province, only 50% of production capacity was reopened following closures due to an insufficient supply of ore.

The predicted surge in demand for natural graphite in line with a growing battery industry has sparked a sharp increase in exploration efforts outside China over the past few years. These new projects are looking to satisfy the increasing demand both in China and the remaining world, as markets for lithium-ion battery applications continue to grow strongly in the automotive and energy storage sectors. The vast majority of exploration work has gone towards the development of flake graphite projects, many of which have been known for quite some time but were not deemed feasible previously due to a depressed price environment.

East Africa has seen unprecedented graphite exploration efforts and the opening of what is set to be the largest natural graphite mine worldwide in Mozambique. Further projects are under construction or awaiting financing and could provide additional supply from the region.

European projects include exploration work in, for example, Sweden and Finland and could contribute to the raw material supply for European-based battery materials production.

While additional supply outside of China is expected to aid companies in their efforts to diver sify supply, it should be noted that the vast majority of processing capacities, in particular pertaining to the battery industry, remain concentrated in China, potentially leading to downstream bottlenecks and issues with the safe and sustainable procurement of raw materials.

The vast majority of processing capacity, in particular pertaining to the battery industry, remains concentrated in China. However, a relaxation from a raw material supply perspective is expected as new graphite projects outside of China are entering the production stage, and this is expected to aid companies in their efforts to diversify supply.