Global uses and consumption of natural graphite was approximately 94700 tons in 2018(RoSkill 2019). The refractory industry is by far the largest consumer of natural graphite, accounting for approximately 46% of global uses and and consumption. Refractory products are used in all high temperature industrial applications. They are thus indispensable in a range of production processes in the steel, non-ferrous, cement, lime and glass industries which are the backbone of many large consumer worldwide.Accounting for 70% of the global share, the steel industry is the largest consumer of refractory products, thus highlighting the importance of natural graphite uses and consumption in this market segment.

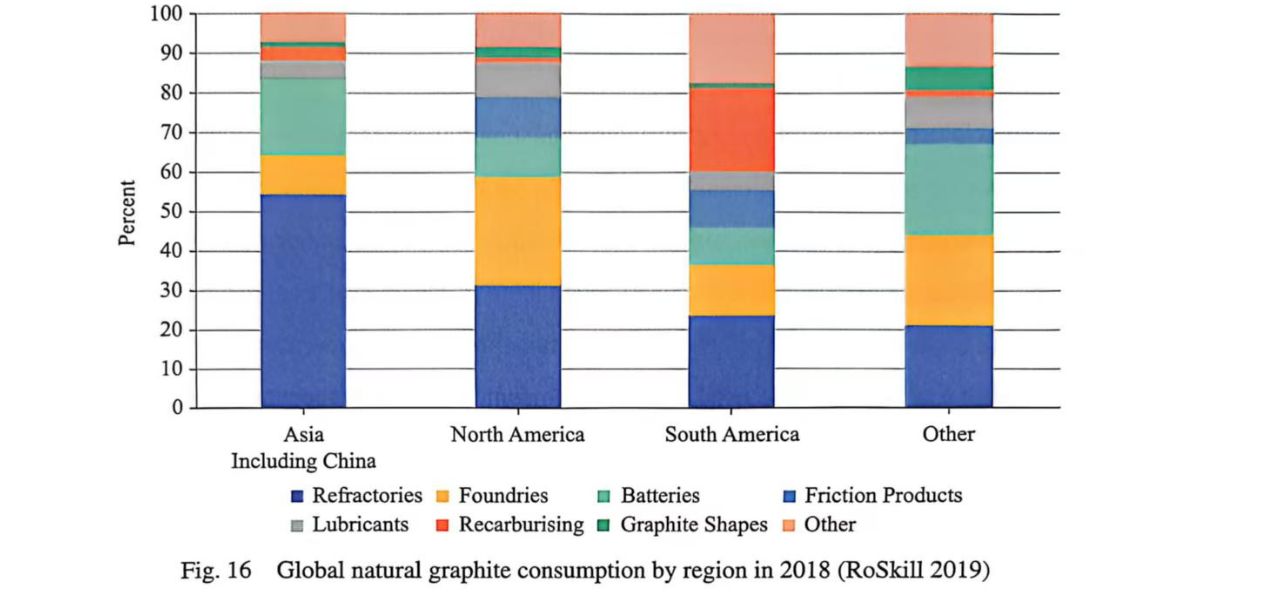

Asian uses and consumption accounted for almost two thirds of global natural graphite consumption, owing to the size of the Chinese refractory and steel industries, with consumption in Europe and the remaining world making up the balance.

Chinese natural graphite uses and consumption

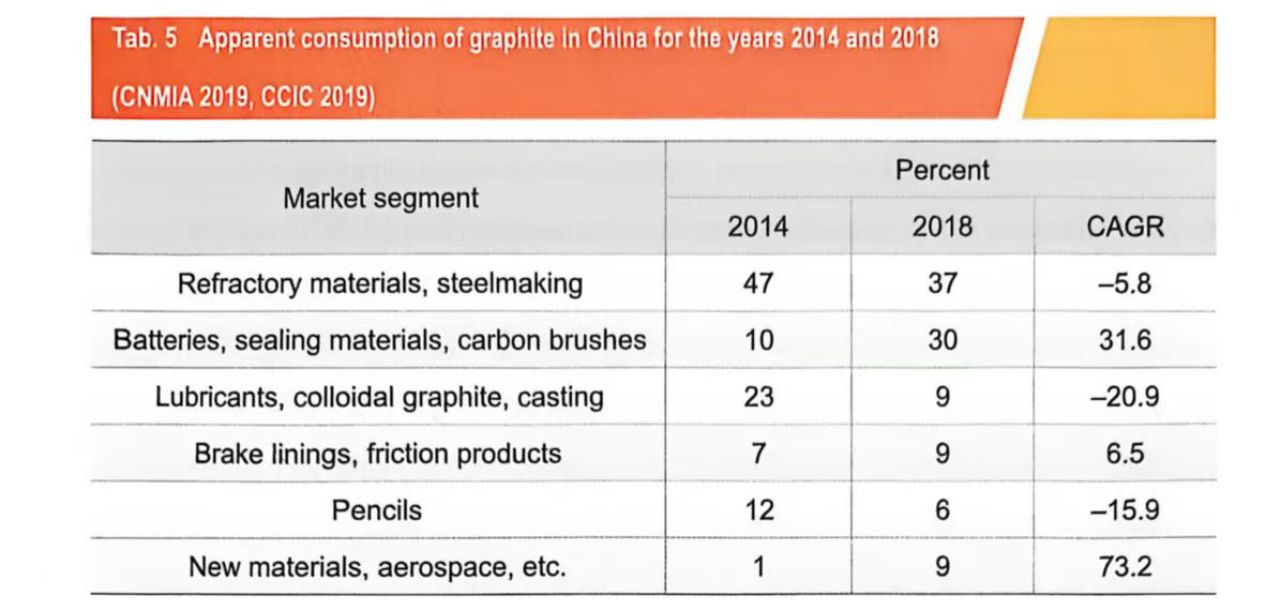

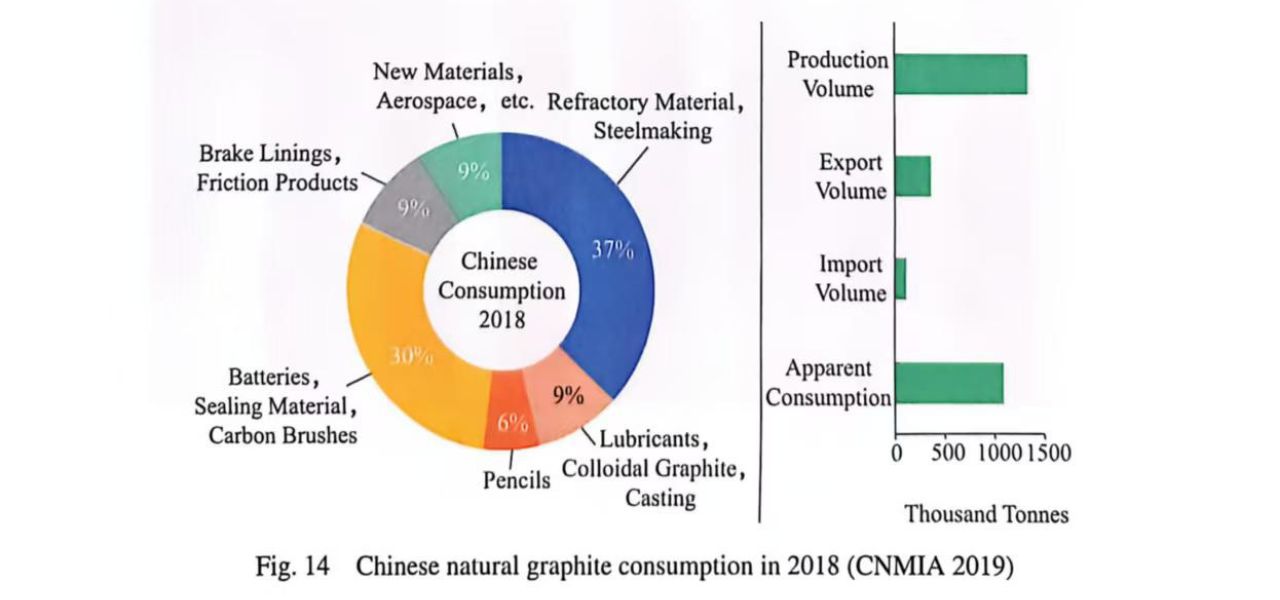

Chinese apparent uses and consumption of natural graphite was roughly 1.02 million ton in 2018, representing an increase of almost 50% compared to 2014. Uses and consumption for new materials in the military, aerospace as well as batteries. Sealing materials and carbon brushes have exhibited double-digit compound annual growth rates(CAGR) over the past few years, while less natural graphite was used in the traditional fields of application such as the refractory industry and in lubricants and casting applications(Tab.5)

Despite a decline in consumption by the refractory industry, China continues to be the largest producer of refractory materials, accounting for 66% of global production(RoSkill 2019). China is also the largest consumer of graphite in battery applications worldwide, a market segment expected to increase its market share over the nest years, with the highest growth forecast for the manufacture of lithium-ion batteries is largely concentrated in China, and Chinese anode manufactures have the largest installed capacities worldwide.

European natural graphite uses and consumption

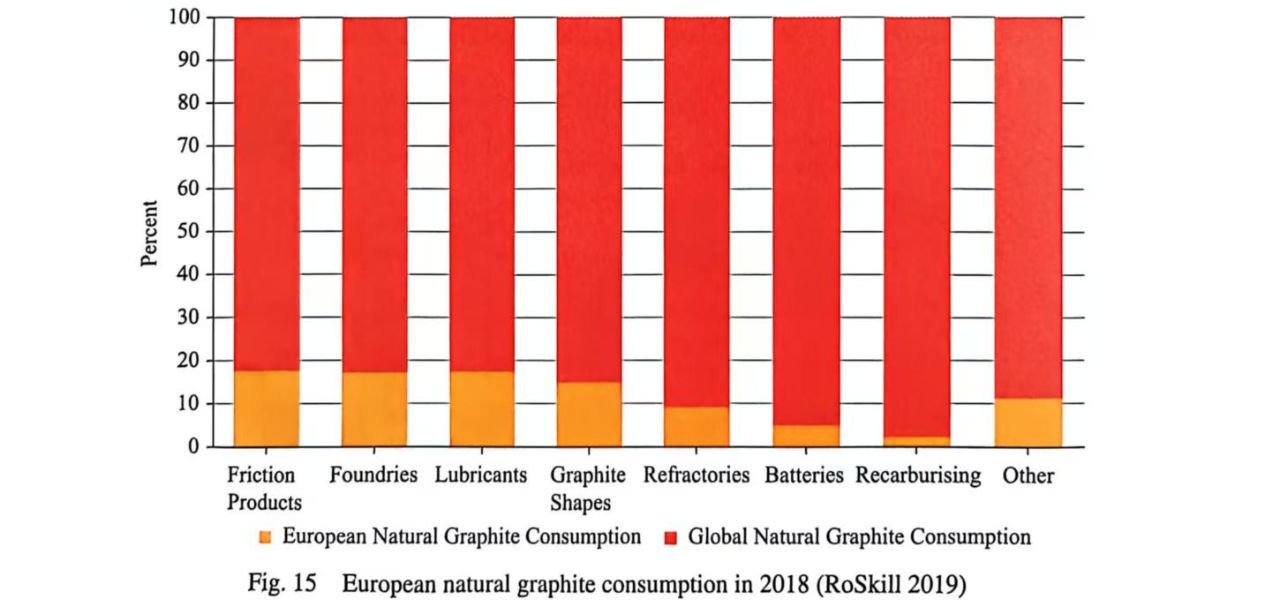

Natural graphite is of fundamental importance to the economies of many European countries. European natural graphite uses and consumption was about 11600 ton in 2018(RoSkill 2019), corresponding to about 12% of global consumption. At approximately 44000 ton, the refractory industry is the largest consumer of natural graphite in Europe and had an 11% share in global production in 2018, the second highest in the world after China(RoSkill 2019)(Fig.15). The main refractory materials consuming industry is the steel industry, and with 167 million ton of crude steel production in 2018, Europe is the second largest steel producer after China, accounting for 17.2% of global steel production in that year(WoRId Steel Association 2019).

The foundry industry was the second largest natural graphite consuming industry in Europe in 2018. At about 28000 ton, second to China and overall Asian consumption, it remains an important consumer of natural graphite in Europe. The foundry industry is closely linked to the performance of steel sector and consumption is predominantly in casting products for the automotive industry, which, with 24% of global motor vehicles output in 2018, represents another industry of major economic importance to Europe(ACEA 2019).

Remaining world natural graphite uses and consumption

Figure 16 shows global natural graphite uses and consumption by region(RoSkill 2019), and Asian consumption (include China) accounting for the major share is about 65%. Consistent with global consumption trends, the refractory industry was the major natural graphite consuming industry.It was the highest in the countries with large refractory and steel-related industries, such as USA, India and Brazil. Indian refractory production grew particularly strongly over the past few years, in line with an increasing in domestic steel production. Latin American refractory production has also increased, driven by rising steel outputs in Brazil, Argentina and Mexico.

While the foundry industry in China is by far the most dominant consumer of natural graphite in this market segment, India has shown significant growth, with the North American foundry industry continuing to hold significant market share as well.

About 98000 ton natural graphite were used and consumed in battery applications worldwide in 2018, about 75% of this in Asia, highlighting the focus of the region as the global center of the lithium-ion battery value chain. The anode industry for the manufacturer lithium-ion batteries continues to be concentrated in China, owing to a number of factors such as the availability of raw materials, location of processing facilities and the downstream manufacturing chain, as well as a strong domestic market. However, Japanese and Korean manufacturers continue to hold some market share, in particular with respect to high performance materials.

Other important graphite uses and consuming industries outside China and Europe include the automotive sector, particularly in other Asian countries such as India and Japan.